India’s finance industry handles thousands of daily voice interactions across customer calls, internal meetings, and compliance logs. With 22 official languages, 19,500+ dialects, and frequent code-switching, traditional speech-to-text systems often fail in real-world finance workflows.

Speech recognition converts voice data into structured text, enabling faster query resolution, more accurate records, and shorter time spent on customer calls. A 2025 industry survey found that 47% of enterprises reduced this time by integrating voice insights into agent workflows, demonstrating real operational gains.

In this blog, you’ll explore how speech recognition can streamline finance operations, strengthen regulatory compliance, and enhance customer service across the financial sector.

Key Takeaways

- Multilingual Capability Matters: Support for Indian languages and code-switching ensures accurate transcription and clear communication with all customers.

- Operational Productivity: Automated transcription and workflow integration free teams from repetitive tasks and reduces errors.

- Faster, Data-Driven Decisions: Structured voice data allows real-time insights, enabling quicker responses to customer queries and market changes.

- Regulatory Readiness: Complete, searchable records support audits, dispute resolution, and compliance, reducing risk exposure.

- Tangible ROI: Voice AI reduces call handling times, lowers operational costs, and strengthens service quality, delivering measurable business value.

Key Challenges in Finance That Speech Recognition Solves

Financial institutions in India face operational hurdles that slow processes and affect service. Managing thousands of calls, meetings, and compliance records adds complexity. Understanding these challenges highlights why speech recognition is essential.

- Multilingual Communication: Customer calls often mix Hindi, English, and regional languages. In India, 98% of internet users access content in Indic languages, and 57% of urban users prefer regional-language content, making manual handling slow and error-prone.

- High Call Volume: Banks, insurance firms, and fintech platforms manage thousands of calls daily, making manual insight capture inefficient.

- Regulatory Compliance: Accurate transcripts are essential for audits, dispute resolution, and fraud prevention, yet manual notes or partial recordings often fall short.

- Workflow Inefficiencies: Tasks like logging calls, summarising meetings, and categorising queries consume significant human resources.

- Customer Experience Pressure: Delays or mistakes in responses can erode trust in competitive financial markets.

Now that we understand the pain points, let’s look at how enterprises can use speech recognition across their finance workflows to create measurable value.

5 Core Use Cases of Speech Recognition in Financial Services

Financial institutions can apply speech recognition to improve efficiency, accuracy, and customer service. Automating tasks and extracting insights from calls, meetings, and IVRs helps teams make faster decisions and maintain compliance. The following use cases demonstrate how speech recognition adds measurable value to finance workflows:

1. Voice‑Activated Banking Assistants

Speech recognition enables virtual banking assistants that allow customers to perform transactions, check balances, or retrieve account information using natural speech. Real-time transcription and intent detection connect these requests seamlessly to backend systems.

- Multilingual Handling: Models trained for code‑switching accurately handle Hindi, Tamil, Telugu, Marathi, and English, reducing errors from language mixing.

- Operational Scale: By automating routine voice interactions, institutions reduce dependency on human agents and handle higher call volumes during peak periods. Evidence from voice AI adoption suggests operational cost reductions of 20–30 % when voice tech is integrated into customer service platforms.

- Workflow Integration: Real‑time transcriptions feed into core systems (CRM, case management), enabling automated approvals, alerts, and faster response times.

Accurate voice assistants improve engagement across India’s diverse language landscape while maintaining seamless integration with existing banking systems.

2. Customer Service Automation

Real‑time speech recognition powers automated call centre workflows by transcribing conversations instantly, tagging key intents, and triggering actions. For instance, a lost‑card call can be transcribed, flagged for urgency, and routed to a specialised team without manual intervention.

- Sentiment and Compliance Insights: Live transcripts support sentiment analysis and detect compliance‑related keywords.

- API‑Driven Integration: Transcription outputs integrate with support systems and dashboards for live operational monitoring.

- Indian Context: Models trained on regional accents and noisy IVR channels maintain high transcription accuracy in real conditions.

Across industries, including BFSI, real‑time voice analytics is contributing to faster resolution and reduced operational friction.

3. Dictation for Financial Documentation

Speech‑to‑text supports internal documentation workflows for analysts, wealth managers, and compliance teams by converting recorded meetings, client consultations, and strategy discussions into structured text.

- Batch Processing: File‑based STT indexes large archives for audit, reporting, and knowledge retrieval.

- Multilingual Accuracy: Code‑switched internal dialogues remain readable and searchable regardless of language mix.

- Operational Impact: Automating documentation reduces manual review effort and enables faster decision-making across teams.

Such transcription workflows convert dormant voice assets into searchable, actionable text that feeds downstream analytics and compliance functions.

4. Fraud Detection & Authentication

Voice biometrics combined with speech recognition enhances identity verification for sensitive transactions.

- Voiceprint Analysis: Unique speech patterns validate caller identity, complementing PINs or OTPs.

- Real‑Time Risk Alerts: Anomalies trigger alerts for fraud monitoring teams.

- Seamless Integration: Works across IVR and mobile voice interactions, including regional languages.

Incorporating voice‑based authentication improves security and reduces manual verification overhead, particularly for high‑value operations.

5. Accessibility for Visually Impaired Users

Speech recognition enables inclusive banking by allowing visually impaired users to interact via voice commands across apps, ATMs, and voice portals.

- Command‑Driven Access: Users can query balances and recent transactions, or initiate actions via speech.

- Multilingual Support: Reliable handling of regional languages ensures accessibility across diverse user bases.

- Regulatory Alignment: Supports compliance with accessibility standards while expanding financial inclusion.

Inclusive voice interfaces improve usability for millions of multilingual users and reinforce social equity alongside operational goals.

Looking to turn multilingual voice data into actionable insights across your finance workflows? Explore Reverie Speech-to-Text with real-time streaming, domain-aware models, and seamless integration. Get started today!

Automate Financial Workflows with Multilingual Speech-to-Text

Reduce operational costs by up to 62% using Reverie’s enterprise-grade solution.

Understanding these applications highlights the key features enterprises should look for when choosing a speech recognition solution for finance.

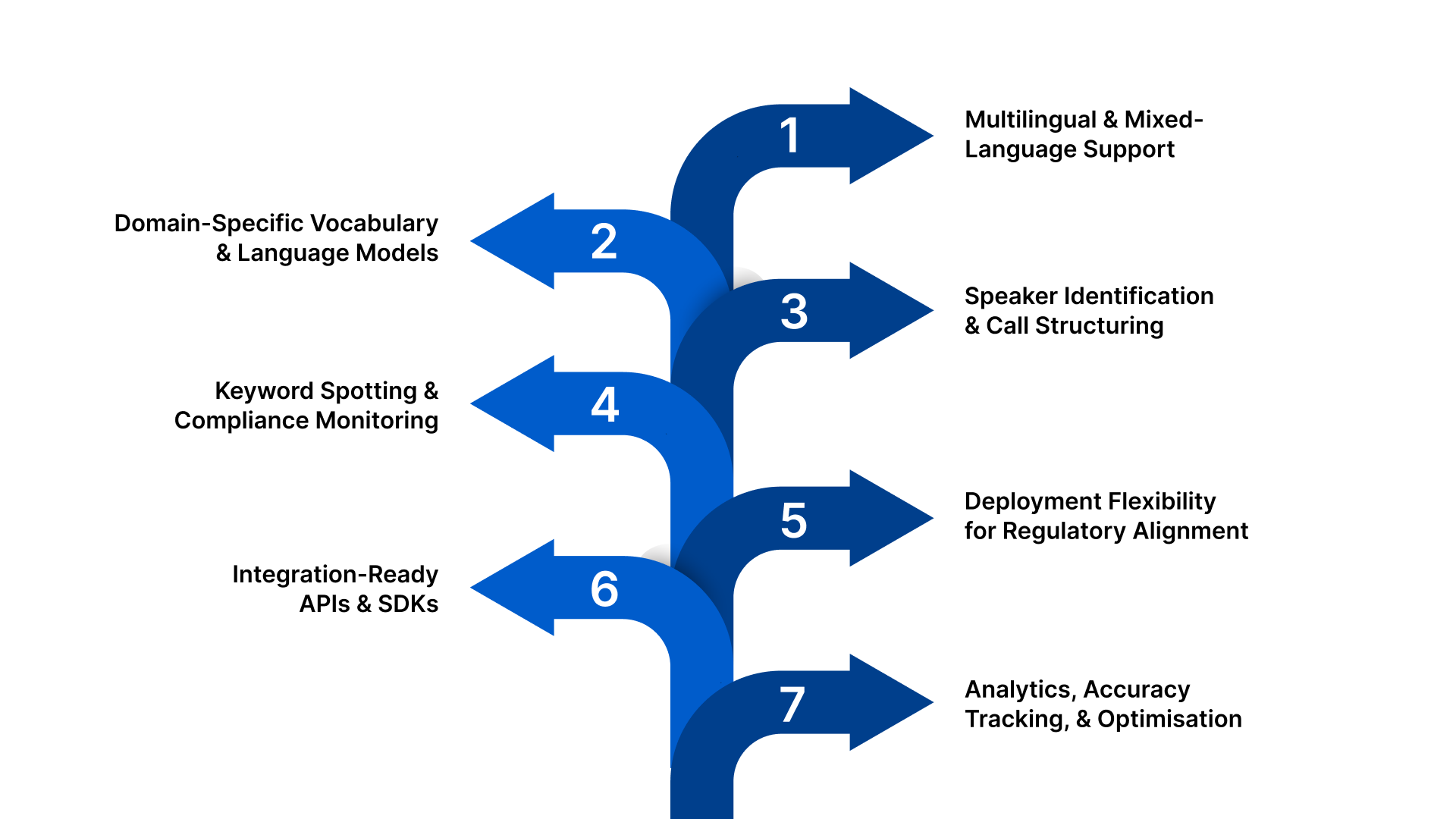

Features That Make Speech Recognition Enterprise-Ready

A speech-to-text solution built for financial services in India must meet strict requirements around accuracy, scale, compliance, and language diversity. Generic transcription tools are not designed for regulated, high-volume finance environments. An enterprise-ready STT platform should include:

- Multilingual and Mixed-Language Support: Real-time transcription across Hindi, English, and regional languages, with support for code-switching that reflects how Indian customers naturally speak during service calls and IVR interactions.

- Domain-Specific Vocabulary and Language Models: Customisable models trained on financial terminology such as loan products, account types, policy terms, regulatory phrases, and transaction workflows to reduce misinterpretation and rework.

- Speaker Identification and Call Structuring: Automatic separation of agent and customer speech in multi-speaker environments, enabling accurate call summaries, audit trails, and quality monitoring.

- Keyword Spotting and Compliance Monitoring: Detection of risk phrases, dispute terms, fraud indicators, and regulatory triggers, alongside profanity filtering to maintain brand safety and service standards.

- Deployment Flexibility for Regulatory Alignment: Support for both cloud and on-premise deployment to meet data localisation, security, and internal governance requirements.

- Integration-Ready APIs and SDKs: Direct integration into IVR systems, mobile banking apps, CRM platforms, and case management tools for end-to-end workflow automation.

- Analytics, Accuracy Tracking, and Optimisation: Dashboards to monitor transcription quality, language performance, call volumes, and operational trends for continuous improvement.

Increase CSAT by up to 52% with Reverie Speech Recognition

Deliver accurate, multilingual, compliance-ready speech recognition for financial services.

Also Read: How Reverie’s Speech-to-Text API is Reshaping Businesses in India

Together, these capabilities allow finance teams to convert large volumes of voice data into structured, searchable, and compliant text, improving decision-making, audit readiness, and service delivery.

The next step is understanding the business benefits and return on investment that speech recognition delivers across finance operations.

Business Value and ROI of Enterprise Speech Recognition

Adopting enterprise-grade speech recognition delivers measurable operational and financial returns for financial institutions operating at scale. By converting voice interactions into structured, searchable data, finance teams gain better control over service quality, compliance, and decision-making.

Key business outcomes include:

- Workflow Efficiency: Automated transcription and workflow integration reduce manual effort, minimise errors, and free teams to focus on higher-value tasks.

- Cost Optimisation: Lower reliance on manual call logging, documentation, and post-call processing results in direct reductions in operational overheads.

- Faster Decision-Making: Real-time transcription and analytics provide immediate visibility into customer queries, risks, and service trends.

- Improved Customer Experience: Accurate multilingual support shortens resolution times and improves service consistency across channels.

- Regulatory Readiness: Complete, searchable call records simplify audits, dispute resolution, and compliance reporting.

Together, these benefits improve service delivery, strengthen governance, and deliver a clear return on investment. Let’s explore how finance enterprises can evaluate and integrate the right speech recognition platform into their workflows.

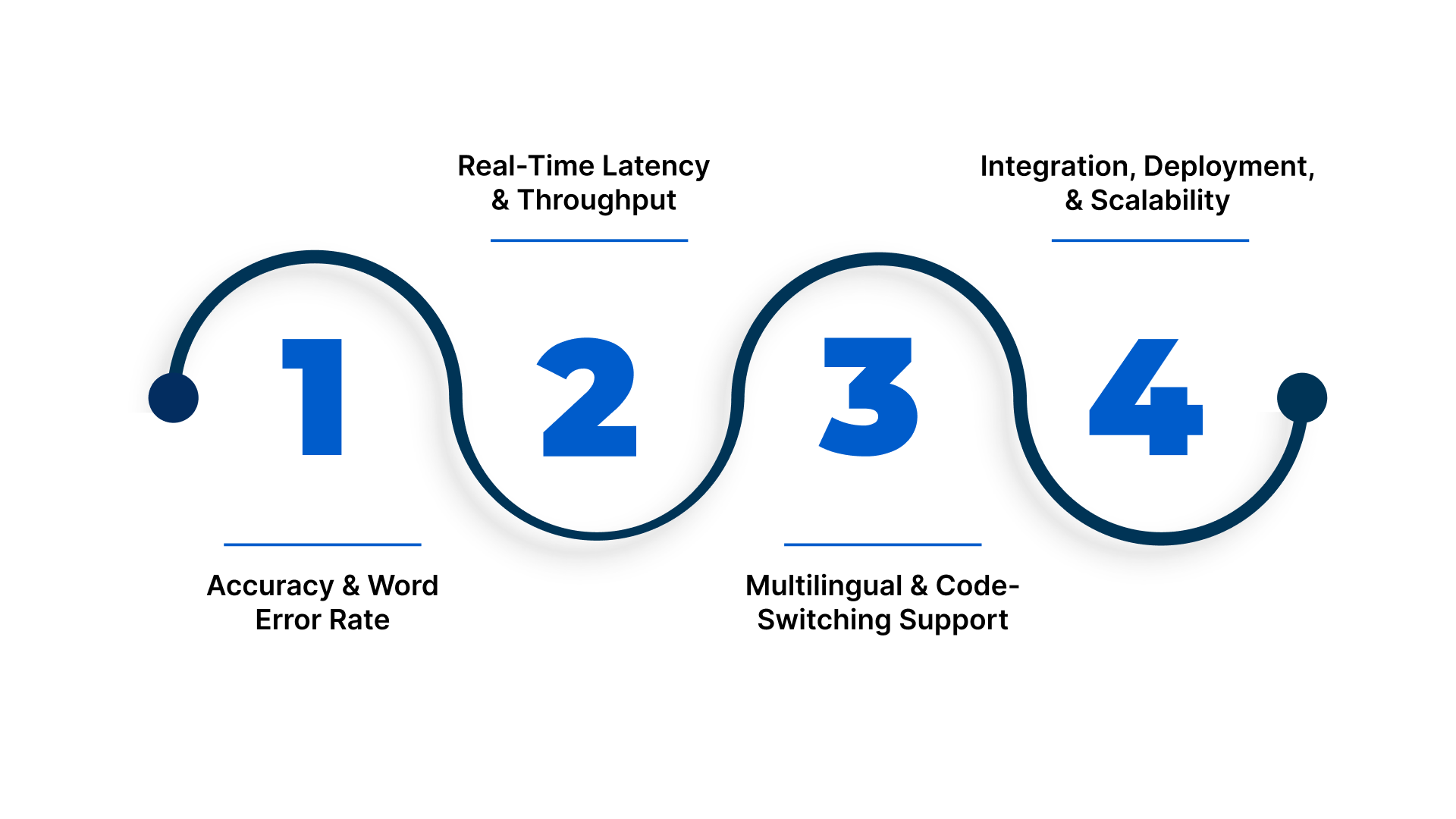

Evaluation Criteria for Choosing Enterprise Speech Recognition

Selecting a speech recognition platform for financial services goes beyond headline accuracy metrics. Enterprises must assess multilingual performance, scalability, workflow integration, and regulatory readiness through real-world testing across IVR, call centre, and app audio. Below are a few key criteria to consider:

1. Accuracy and Word Error Rate (WER)

Accuracy is crucial for compliance, audits, and customer interactions. Word Error Rate (WER) measures transcription errors, with Indian accents and code-switched speech adding complexity. Evaluations should cover real operational audio, domain vocabulary, and entity-level correctness.

2. Real-Time Latency and Throughput

Latency impacts routing, intent detection, and automated responses. Real-time systems must sustain sub-second performance under peak workloads. Assess latency under load, concurrent stream handling, and streaming stability for long or noisy calls.

3. Multilingual and Code-Switching Support

Platforms must handle multiple Indian languages and intra-sentence code-switching. Coverage of Hindi, Tamil, Telugu, Marathi, and dialects is critical. Custom finance-specific models reduce misinterpretation of codes, amounts, and entity names.

4. Integration, Deployment, and Scalability

APIs and SDKs should support web, mobile, and server environments, with real-time and batch workflows. Cloud and on-premise options must align with compliance needs. Proof-of-concept testing validates throughput, reliability, and integration before enterprise rollout.

Curious how Indian-language speech can enhance customer interactions and analytics? Use Reverie Speech-to-Text for accurate, scalable multilingual transcription across apps, IVR, and workflows. Start today with free API credits and hands-on SDKs!

Also Read: Power of Speech to Text API: A Game Changer for Content Creation

By focusing on these criteria, financial enterprises can select a solution that simultaneously drives efficiency, compliance, and customer satisfaction.

Final Thoughts

Speech recognition has become a core operational capability for financial institutions managing high volumes of voice interactions across customer service, compliance, and internal workflows. Converting spoken conversations into accurate, searchable text enables finance teams to improve service quality, strengthen regulatory processes, and extract actionable intelligence from everyday interactions.

Reverie Speech-to-Text meets these enterprise needs with Indian-language‑optimised ASR, supporting real-time streaming and batch transcription, domain-aware models, and seamless workflow integration. Organisations can embed voice capabilities into IVR systems, apps, and analytics platforms while maintaining accuracy across regional and mixed-language conversations.

Sign up now to see how Reverie’s Speech-to-Text API can streamline finance workflows, improve accuracy, and turn every conversation into actionable insights.

FAQs

1. How can speech recognition help detect customer sentiment in financial calls?

Advanced STT platforms convert voice to text in real time, enabling sentiment analysis that identifies frustration, satisfaction, or urgency to guide agent interventions.

2. Can speech recognition integrate with analytics dashboards for trend monitoring?

Yes. Transcribed voice data can feed directly into BI tools or dashboards to track call patterns, frequently asked queries, and operational bottlenecks.

3. How does STT improve training for finance call centre agents?

Recorded calls transcribed with high accuracy allow managers to review performance, provide feedback, and create scenario-based training content efficiently.

4. Is voice AI effective for regional-language fraud detection?

Yes. Keyword spotting in regional languages can flag suspicious transactions, unusual queries, or repeated phrases that indicate potential fraud.

5. Can speech recognition support multi-channel finance workflows beyond calls?

Absolutely. STT can process IVR interactions, mobile app voice commands, internal meetings, and even voice notes, creating a unified searchable repository across channels.