Banking, once defined by queues and branch visits, has evolved into a dynamic digital experience. Yet, even with the convenience of mobile apps and chat interfaces, there’s an underlying need to simplify further. As digital maturity rises, there’s a growing need for interactions that are less about screens and more about natural, seamless conversation. Speech-to-Text (STT) in banking is helping close that gap.

Speech-to-Text converts spoken input into usable, structured text that digital systems can process instantly, allowing services to respond with minimal user effort. Recent studies indicate that 56% of smartphone users rely on voice search to find information about brands and businesses, highlighting a significant shift towards voice-enabled interactions in daily life. This trend underscores a deeper demand for immediacy, inclusion, and clarity in everyday financial services.

Banks are now starting to realise that traditional UI is just one half of the user experience. The other half is the conversation, including “what people say,” “how they say it,” and “how quickly it can be understood and actioned.” Speech-to-Text enables this by capturing spoken input and turning it into structured data, instantly.

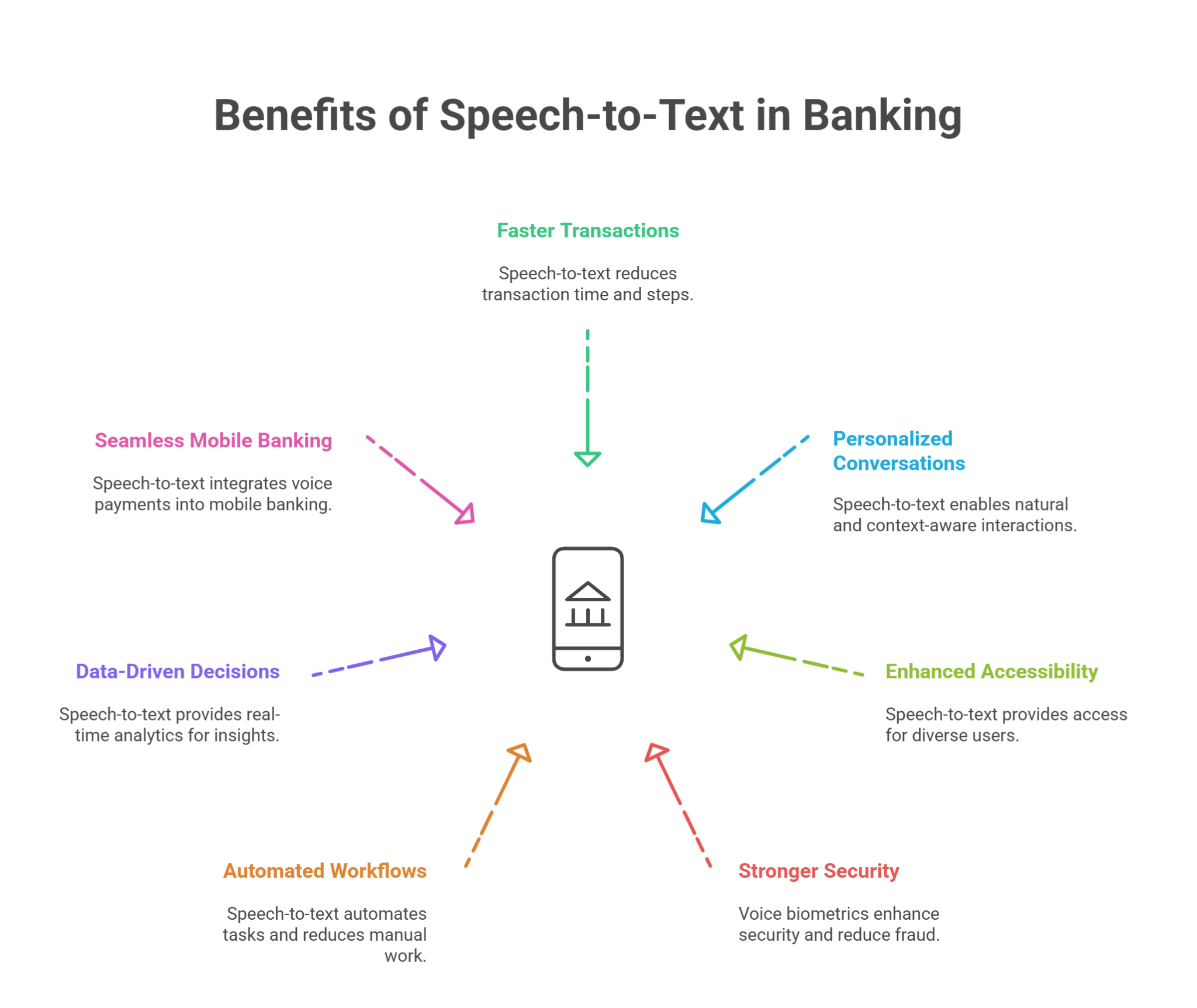

Below are seven specific ways Speech-to-Text is being used to create real impact within modern banking systems.

Benefit 1: Faster Transactions & Reduced TAT (Turnaround Time)

Customers expect fast execution, especially for familiar, high-frequency tasks like fund transfers, bill payments, or checking account balances. Delays often come not from system inefficiency, but from the number of steps involved in completing a task. Speech-to-Text simplifies this by turning a spoken instruction into action without toggling through forms or menus.

- Real-time processing: Voice input is instantly transcribed and interpreted, reducing multi-step workflows to one command.

- Reduced queue time: Customer service centres benefit from automated voice intake that routes issues immediately without agent dependency.

- Minimal error entry: Speech avoids the common typing errors associated with mobile apps or unresponsive interfaces, increasing transaction accuracy.

Example:

A customer walking through a commercial area wants to quickly locate the nearest ATM without opening and navigating the banking app. They say, “Where’s the closest ATM?” The system transcribes the query instantly, identifies their location, and responds with directions, completing the task in seconds without disrupting their movement.

Benefit 2: Elevated Customer Experience with Personalised Conversations

Customer expectations have evolved beyond standard response templates. They want systems that understand natural language, respond based on their transaction history, and adapt to the urgency or tone of the situation. Speech-to-Text in banking makes this possible by enabling conversational banking operations that feel responsive and human, even when fully automated.

- Natural query handling: Users can speak in everyday language without having to memorise commands or keywords.

- Context-aware responses: Voice input allows the system to gauge sentiment, urgency, and transaction intent more accurately than typed queries.

- Memory-driven interactions: Previous voice interactions can inform personalised replies, speeding up service and creating continuity across touchpoints.

Example:

A customer says, “Did I already pay my credit card bill this month?” The system transcribes the query and pulls recent payment activity. It replies with an exact answer, avoiding app navigation or repeated explanations, and resolving the concern within one seamless voice interaction.

Benefit 3: Enhanced Accessibility for All Customers

Digital inclusivity is becoming a non-negotiable for modern banking. Many users, particularly the elderly, differently-abled, or those unfamiliar with written English, face real challenges using app-based interfaces. Voice technology removes these barriers, allowing access through the simplest interface of all: speech.

- Support for physical limitations: Users with vision or motor impairments can perform banking tasks without needing to touch or view their device.

- Language flexibility: STT engines configured with multilingual capabilities allow customers to interact in their native or preferred language.

- Simplified access paths: By eliminating the need for traditional navigation, users can skip multiple steps and complete tasks faster.

Example:

A pensioner, unfamiliar with smartphone interfaces, wants to confirm if their monthly income has been credited. They say, “What’s my last credit?” The system understands the request, accesses the record, and reads out the transaction details, removing the need to visit a branch or use a text-based interface.

Benefit 4: Stronger Security Through Biometric Voice Authentication

Security concerns are at the heart of every banking innovation, and authentication remains a critical point of friction for users. Traditional methods like OTPs or passwords introduce delays and are vulnerable to theft. Voice biometrics provide a secure alternative by using a person’s unique speech features to verify identity.

- Unique voiceprint recognition: Each voice carries identifiable markers like pitch, rhythm, and tone that are difficult to replicate.

- Continuous verification: Even during ongoing conversations, systems can monitor for mismatched speech patterns or suspected impersonations.

Benefit 5: Automated Workflows That Cut Costs

Banking efficiency is tied closely to how much human involvement is required for routine actions. When everyday queries and tasks still demand agent intervention, costs escalate. Speech-to-Text in banking helps automate workflows by transcribing requests in real time and routing them intelligently to the right system or resolution path.

- Reduced manual workload: Voice requests can be automatically converted into service tickets or transaction commands, reducing the need for human intervention and speeding up backend processing.

- Intelligent query classification: Natural language input allows systems to identify the core need and direct it appropriately across departments.

- Accurate documentation: Each voice session is transcribed and logged, reducing data loss and creating reliable trails for compliance or analysis.

Example:

A user leaves a voice message saying, “I think I was charged twice on Sunday at the petrol station.” The system captures the audio, identifies it as a potential dispute, and creates a case file with the relevant transaction details. The issue is queued for review without waiting for a manual follow-up or agent input.

Benefit 6: Data-Driven Decisions With Real-Time Analytics

Banks handle a high volume of voice-based customer interactions each day. Without transcription, most of these conversations remain unstructured and unusable for insights. Voice-to-Text for financial services turns voice data into text that can be searched, categorised, and analysed. It helps teams uncover patterns, resolve issues faster, and improve service delivery with real-time decision support.

- Actionable call summaries: Transcribed voice interactions provide context for teams to improve handling and escalation accuracy.

- Trend identification: Analytics dashboards highlight recurring topics or complaints, helping product and service teams act early.

- Audit-ready records: Text-based logs create secure documentation that supports compliance and regulatory reporting.

Example:

A customer experience team notices more people asking about premature withdrawal charges on fixed deposits. Using transcribed voice queries, they identify common patterns and confusion around the displayed terms. This insight helps them update the app’s language and streamline in-branch communication.

Benefit 7: Seamless Mobile Banking with Voice Payment Integrations

Mobile banking often happens in environments where screens aren’t easy to use. Speech-to-Text in financial services enables users to complete payments or access information through simple spoken commands. It increases user engagement by offering faster, touch-free transactions across phones, smart speakers, and embedded interfaces in wearable devices.

- Effortless payment triggers: Customers can send money or pay bills by voice, reducing reliance on screens and clicks.

- Improved engagement: Faster interactions encourage users to manage tasks like reminders, recharges, or balance checks more often.

- Integration flexibility: STT supports cross-platform integration into mobile apps, kiosks, smartwatches, and voice-first devices.

Example:

A customer using mobile banking remembers a utility bill that’s due while checking account details. Without switching screens, they say, “Pay the electricity bill for ₹1,200.” The system processes the request immediately and confirms it out loud. The task is completed in a few seconds, without manual entry or app navigation.

Reverie Speech to Text API for Scalable Voice Driven Banking

Most banking systems aren’t built to handle how people actually speak. Customers pause, switch languages, use informal phrasing, or speak from crowded places. Reverie’s Speech-to-Text API is purpose-built for BFSI that operates across India’s linguistic and operational diversity.

Here are the capabilities that make Reverie’s STT API uniquely suited for banking teams looking to operationalise voice across real-world use cases:

- Built to Understand Indian Speech Patterns

The API captures voice input and instantly converts it into structured text across 11 supported Indian languages. It handles regional pronunciation, mixed-language speech, and audio imperfections typical in customer conversations, ensuring nothing gets lost in translation.

- Ready for Everyday Banking Workflows

From service calls and mobile voice commands to IVR inputs, the API handles a wide range of use cases. It converts speech into clean, structured text and pushes it into ticketing systems, dashboards, or digital forms. This reduces manual errors and lets service teams focus on tasks that need their attention.

- Insights From Every Voice Interaction

Once conversations are transcribed, they become measurable. Banks can review recurring phrases, identify customer pain points, and spot gaps in service delivery. These insights help teams refine processes, train support staff more effectively, and build smarter self-service options based on what customers are saying.

- Fast Setup and Developer-Friendly Integration

With Reverie’s RevUp platform, banks can begin testing voice workflows in minutes. Developers get immediate access to sandbox environments, sample integrations, and usage credits. This makes it easier to validate use cases early, fine-tune accuracy, and accelerate rollout across mobile apps, contact centres, or internal platforms.

Time to Make Your Bank Voice Ready

Financial institutions are rethinking how customers engage, moving beyond screens and clicks to natural conversations. From simplifying everyday tasks to supporting users across languages and literacy levels, Speech-to-Text for BFSI creates real opportunities to improve speed, efficiency, and accessibility.

Banks that integrate voice are not just enhancing convenience. They are removing unnecessary steps from daily interactions, making access more seamless, and giving frontline teams the ability to respond faster with greater accuracy.

Reverie’s Speech-to-Text API brings all of this into a system built for India, ready for multiple languages, variable audio, and scalable operations. If your teams are exploring ways to build smarter, more responsive digital transformation in banking, this is the right time to move forward.

If you’re ready to explore what voice can do for your banking operation, book a demo with us and experience the difference.

Faqs

How does speech-to-text reduce operational delays in banking?

Banks use speech-to-text to capture and process spoken customer requests in real time. This reduces reliance on manual entry and shortens resolution time for routine tasks like account queries, transaction requests, and service ticket creation.

Why is Reverie’s speech-to-text solution more suitable for Indian banks?

Reverie’s API supports 11 Indian languages and recognises common speech patterns across regions. It handles real-world audio input from customers, including mixed-language commands, and returns accurate, structured data that integrates smoothly into banking workflows.

Can banks rely on speech-to-text for use cases beyond customer service?

Yes. Banks use speech-to-text for IVR routing, internal documentation, feedback capture, and voice-enabled onboarding flows. Reverie’s API supports all these with scalable performance and high transcription accuracy under varied audio conditions.

What kind of banking tasks benefit most from voice input?

Tasks that involve frequent customer interaction, repetitive queries, or mobile engagement benefit most. This includes balance checks, form filling, complaint logging, and transaction instructions—all of which can be handled faster through voice.

How quickly can a bank start using Reverie’s speech-to-text API?

Reverie provides instant access through its RevUp platform. Banks can test live inputs, access sample integrations, and deploy in real use cases within days. The onboarding process is designed for minimal technical friction and faster evaluation.